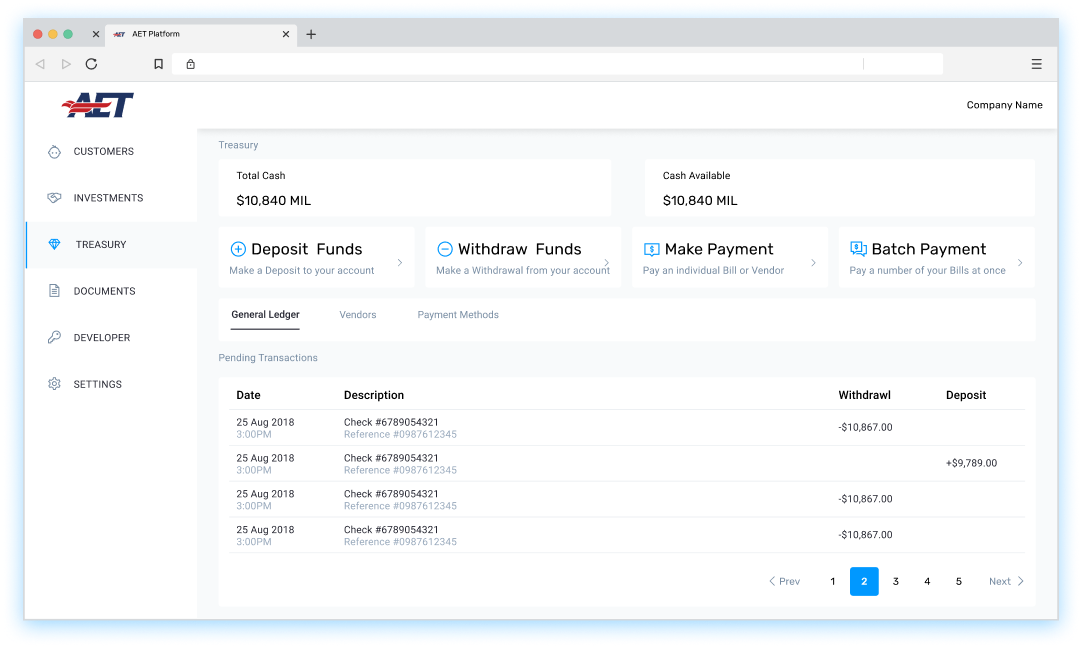

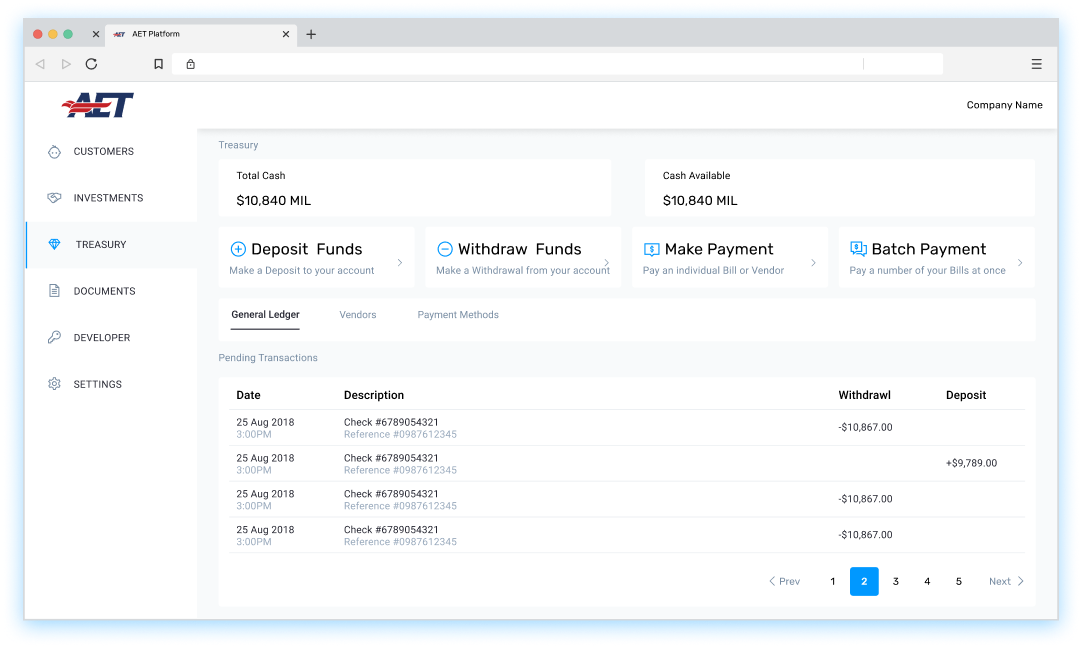

Cash Management

Send, Receive & Hold Funds

Safely and securely manage investor funds from a single, user-friendly portal.

- Link financial accounts

- Make distributions

- Collect fees

- Track transaction history

Multi-Faceted

Serving Investments Across the Board

Trust Platform™ supports a diverse range of fund structures and registration types.

Fund Structures

AET supports a wide range of funding options:

- Private Equity

- Real Estate Funds

- Commodity Pools

- Pension Funds

- Crowdfunding

- Fund of Funds

- Endowment Funds

- Hedge Funds

Registration Types

Private Placements

Reg D Funds

506 (a), 506 (b), 506 (c)

506 (a), 506 (b), 506 (c)

S-11 REITs

Reg A+ Funds

Fund Accounting

Financial Reporting Made Simple

Trust Platform’s back end handles accounting and reporting processes at the fund, institutional, or asset levels – all while maintaining the highest compliance standards.

- Tax Services

- Portfolio Reporting

- Financial Statement Prep

Technology

Consolidated Digital Portals

Comprehensive dashboards for you and your investors.

- Provide unparalleled transparency

- Automate investor onboarding

- Manage & scale internal processes

Learn More About AET Solutions