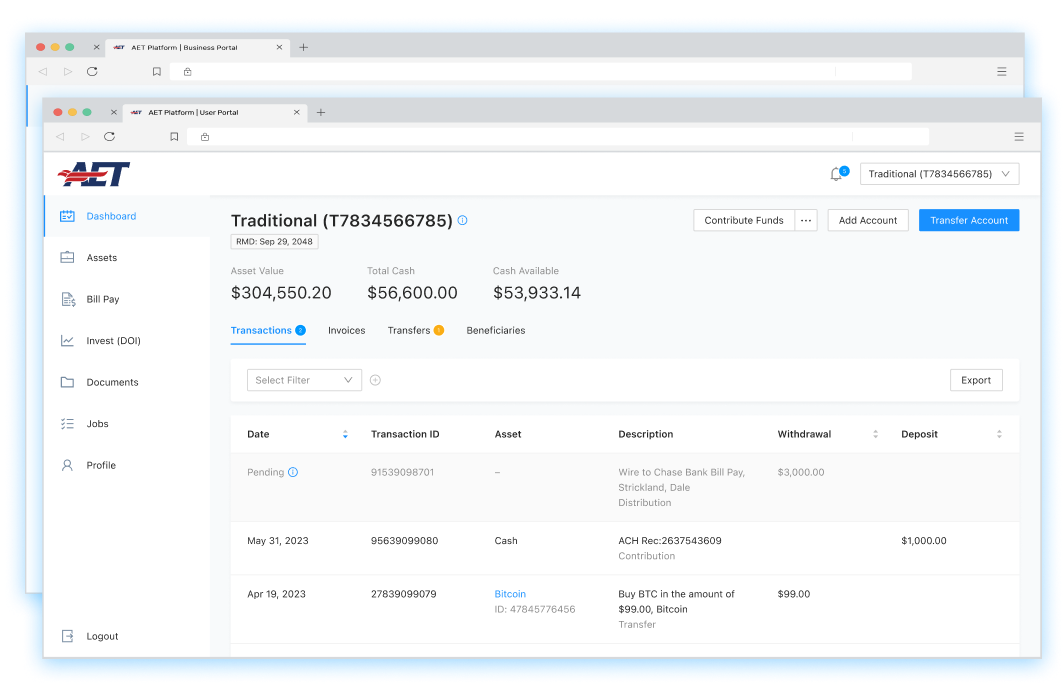

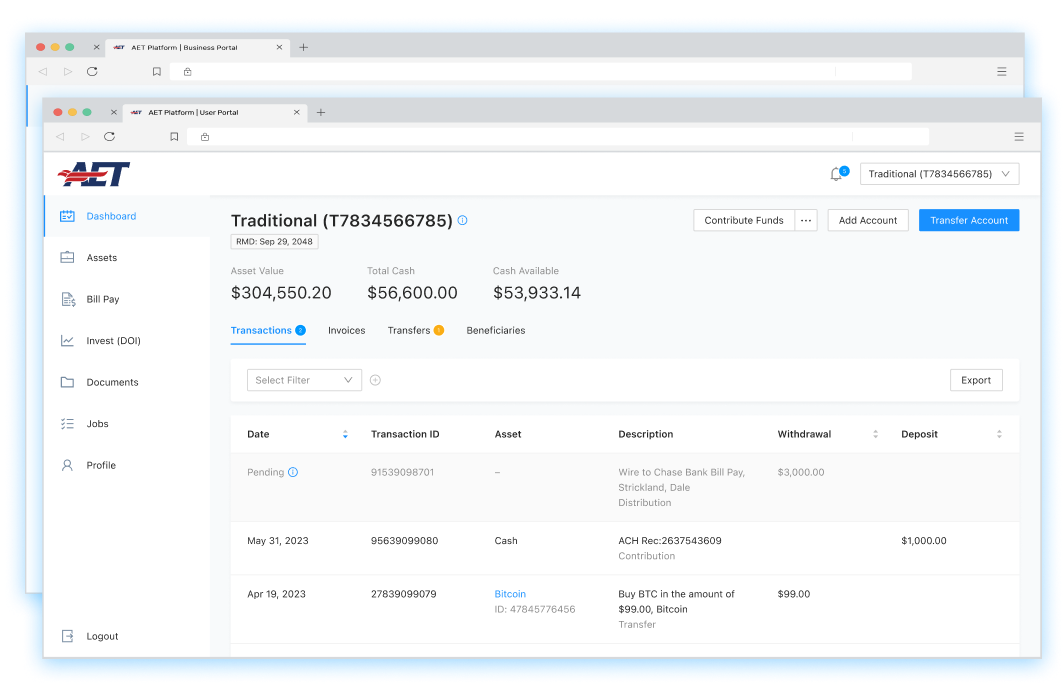

Streamline the way you manage clients and investors while providing a seamless user experience. Trust Platform™ comes with two interfaces:

Trust Platform™ gives you the ability to accept and allocate tax-advantaged dollars toward a variety of private asset classes.

Create an Investment

Opportunity or Asset

Invite Clients or

Client Groups to Invest

Track, Report and

Pay Dividends

Advising client portfolios? Trust Platform™ makes it incredibly easy for planners and advisors to administrate accounts and initiate investment decisions.

Learn MoreWe support virtually every type of self-directed retirement account. Your clients can use any of the following to fund supported alternative assets:

- Traditional IRAs

- Roth IRAs

- Solo 401(k)s

- Simple Employer Pensions (SEP)

- Health Savings Accounts (HSA)

- Cash Savings Accounts

White-label the Trust Platform™ to give your Investor Portal a customized look and feel. Create your own log-in domain, logo, and brand colors to end-user dashboards.

Learn More