Holding REITs in IRA & Other Retirement Accounts

Takeaways

- Real estate investment trusts are increasingly accepted as part of the portfolio of a qualified retirement plan.

- Direct real estate investment can legally be included in qualified retirement accounts, but most administrators will direct their clients toward REITs, real estate stocks, and mutual funds.

- REITs garner favorable tax treatment, which is amplified via Roth IRAs.

- Employer-sponsored plans such as 401(k)s generally have fewer real estate investment options than IRAs do.

Beyond stocks and bonds

There is a physical Wall Street in lower Manhattan, but that’s not what most people mean when they say “Wall Street.” In common parlance, it’s a term for the entire U.S.-based financial services industry. Similarly, there are two sides to the metonymic Street.

On the one side are the people who embrace the abstract. They design synthetic instruments modeled by formulae involving half the Greek alphabet. Hedge fund managers pay these quants top dollar for insights on how to best time a put on a knock-in barrier option and how to hedge their positions with such exotic-sounding strategems as bull call spreads, butterflies, and strangles.

On the other side are the people charged with protecting the interests of individuals, families, and businesses. This is where investment adviser representatives go to work. As employees of fiduciaries – which registered investment advisers by definition are – they have to adhere tightly to laws and stay well within bounds of compliance. This is the real world, where you endeavor to buy shares low and sell them high and purchase investment-grade bonds to guard against stock market swoons.

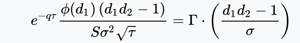

Rate of change of gamma concerning changes in volatility — or a spanikopita recipe? You decide. Credit: Espen Gaardner Haug, The Complete Guide to Option Pricing Formulas (2007).

Of course, it’s not that cut-and-dried. There are many non-stock, non-bond, non-cash instruments that a fiduciary can acquire and hold for those it serves – and real estate investment trusts are at the top of the list. Still, the science isn’t quite settled.

RIAs must select “a 401(k) lineup that is diversified across a sufficient number of asset classes,” according to consultancy Faegre Drinker. “Unfortunately, the guidance issued by the Department of Labor does not specify which, or how many, asset classes should be included.”

Faegre Drinker’s Fred Reish and Bruce Ashton advise fiduciaries to “consider including at least one investment from each of the major asset classes,” and that “prudent plan sponsors should consider including real estate as an asset class, and REITs as an investment alternative, in their plans.”

Less taxing

It’s essential to define the terms here. Say you have a seven-digit qualified retirement account and, of that, you want to park $250,000 in real estate. The first thing you need to do is not watch HGTV because fix-and-flips might not fit in the portfolio.

Fixing this up and selling it might not be the best way to fund your retirement. Credit: “Flip or Flop,” HGTV.

When it comes to real estate, you can invest directly in actual rental property. For that $250,000, you could conceivably buy a two- or three-unit building in some markets, then collect rent. But again, this doesn’t constitute a financial instrument, and some RIAs would advise you not to do it.

That doesn’t mean you can’t.

“Although investing IRA funds directly in a piece of property is entirely legal, many IRA administrators will not allow such investments,” according to RealtyMogul, a Los Angeles-based REIT. It suggests self-directed IRAs and solo 401(k)s as ways to work around recalcitrant administrators.

Despite the criticisms, however, there are several advantages to investing in a piece of property directly, and many investors prefer it over more traditional, vanilla investments.

What most RIAs would advise their clients to invest in, though, are real estate stocks, real estate mutual funds, and REITs. Of the three, REITs are the most common because there is a significant advantage for real estate firms to structure themselves this way: They aren’t taxed at the corporate level. Like limited liability corporations, income isn’t taxed until it’s paid out to shareholders.

“This is a big tax benefit,” South Carolina-based financial planner Matt Frankel writes for The Motley Fool. “With most dividend-paying stocks, profits are effectively taxed twice — once at the corporate level, and then again at the individual level when they’re paid out as dividends.”

To qualify as a REIT, the organization must invest at least three-quarters of its assets in and derive three-quarters of its income from real estate, then pay at least 90% of its taxable income to shareholders as dividends.

But if IRAs are tax-shielded and REITs are tax-shielded, does it make sense to invest in a REIT via your IRA? Very often, the answer is “yes.”

“If you own REITs in [a traditional] IRA, you won’t have to pay taxes on that income until you take money out of the IRA,” according to financial journalist Reuben Gregg Brewer. “If you own the same REITs in a regular brokerage account, you’ll pay taxes in any year you receive distributions. So there is still a tax benefit to owning REITs in a traditional IRA in that you can defer the taxes you’d be paying on the income you receive.”

Brewer notes that the tax treatment is even better if you keep the REIT in a Roth IRA, through which “you pay taxes on the money that you put in and pay no taxes on the money when it’s taken out. You get tax-free compounding and the chance to avoid taxation in the future because the entry price was paying taxes upfront. … In other words, a Roth is a great home for a REIT.”

At the close

Ultimately, though, the fiduciary can only advise. If the client doesn’t take that advice, the fiduciary can decline to keep the business.

But this whole REITs-in-IRAs discussion opens up several cans of non-arthropod invertebrates. First is that different types of IRAs make better use of REIT tax advantages than others. Next is that some qualified plans are more amenable to direct real estate investment than others. Further, it bears mentioning that employer-sponsored 401(k) and related plans are likely to offer fewer real estate investment options than IRAs in general.

Beyond that, though, it’s crucial to bear in mind the cautious note from Faegre Drinker about the lack of clarity of what constitutes an asset that belongs in a retirement fund advised by a fiduciary. Is an investment adviser representative bound to prefer a REIT over a real estate stock because of the tax treatment? Is there a good reason why direct investment is frowned on by fiduciaries or is this just a case of “that’s the way we’ve always done it”?

And let’s go, as the sci-fi nerds like to put it, “15 minutes into the future”. You’ve heard about non-fungible tokens. NFTs are unique digital tokens representing one-of-a-kind objects. These are typically related to the arts, sports trading memorabilia, or in-game assets. But what’s more remarkable, one-of-a-kind, and non-fungible than real estate? When a property becomes identifiable by an NFT-style deed, will such instruments then be deemed prudent enough for fiduciaries to bless?

If so, what’s the next step? Will RIAs someday be dealing in CryptoKitties?

Share article