.png)

RIA Considerations for Alternative Investments in 2023

Logan Rittenberg

As an advisor, your mission is to help your clients achieve financial security. Among several factors, your client's financial objectives, risk tolerance, and time horizon will vastly inform your strategy. We want to choose the best formula to help our clients thrive – and there are an ever-increasing number of routes to success.

There has been a sea-change in the market's interest over the last fifteen years – particularly around alternative investments. Investments that were gatekept by institutional market makers, hedge funds, and ultra-high net worth individuals are now available to the common investor – paving new paths and opportunities for RIAs. Total private capital under management has grown by 53.4% from 2019 to 2023 [Preqin].

Why alternatives?

While traditional stocks, bonds, ETFs, and mutual funds remain commonplace, exposure to alternative investments could fill gaps.

The typical 60% stock/40% bond portfolio declined by about seventeen percent in 2022.1 This traditional allocation structure might not be optimal during times of rising interest rates and inflation. More RIAs are looking to non-correlated assets like private equity, private credit, real estate, infrastructure, and natural resources for portfolio diversification, risk mitigation, and enhanced returns.

How do RIAs feel about alts?

RIAs and their clients are warming up to alternative investments.

In a report conducted by CAIS, they polled 198 financial professionals and uncovered the following:2

- Approximately 88% of financial advisors want to increase their investments in alternative asset classes by the end of 2024

- 89% of alternative asset managers and other financial professionals said that accessing the private wealth has become a bigger priority for their firm

- 85% of financial advisors said that their clients were now more interested in a mix of either new products, new structures, or both, compared with six months previously.

The report also documented reluctance toward alternatives:

- Lack of liquidity

- High levels of administration and paperwork

- Concerns around due diligence

Similarly, Horizon Investments interviewed 468 investment professionals during the Summer of 2023.3 They found that advisors were reluctant to offer alternatives because they couldn't access deals or proper education about the investments – making it difficult to vet opportunities or perform due diligence.

How is the industry addressing concerns for alts?

Liquidity

Alts can be illiquid investments. A venture capital investment, for example, can tie your client's funds up for anywhere between 5-10 years. Institutional investors will hold real estate assets for an average of 7.6 years.4 Current and future spending requirements and the investor's life stage need to be considered. Is your client expecting to make significant purchases in the short term? Are they approaching retirement age?

In some cases, illiquid investments can benefit the investor. Perhaps public markets are volatile; the temptation to waver and make premature investment decisions can harm the life of the investment. Holding positions in an illiquid asset like an apartment complex or plot of land will prevent knee-jerk reactions to the turning tides of the market.

Another scenario that plays in harmony with illiquidity might be to hold the asset in a self-directed retirement account. Regardless of the assets held inside, an IRA enforces that funds are maintained in the account until the account holder reaches age 59 ½. The investor has already committed to having their funds locked up for a predetermined time. They can reap potential gains and tax benefits with less concern over liquidity.

Moreover, there are options if your client's risk profile cannot tolerate highly illiquid assets but might benefit from exposure to alternatives. Interval funds, among other fund investments, can have more frequent redemption periods.2

Administration/Paperwork

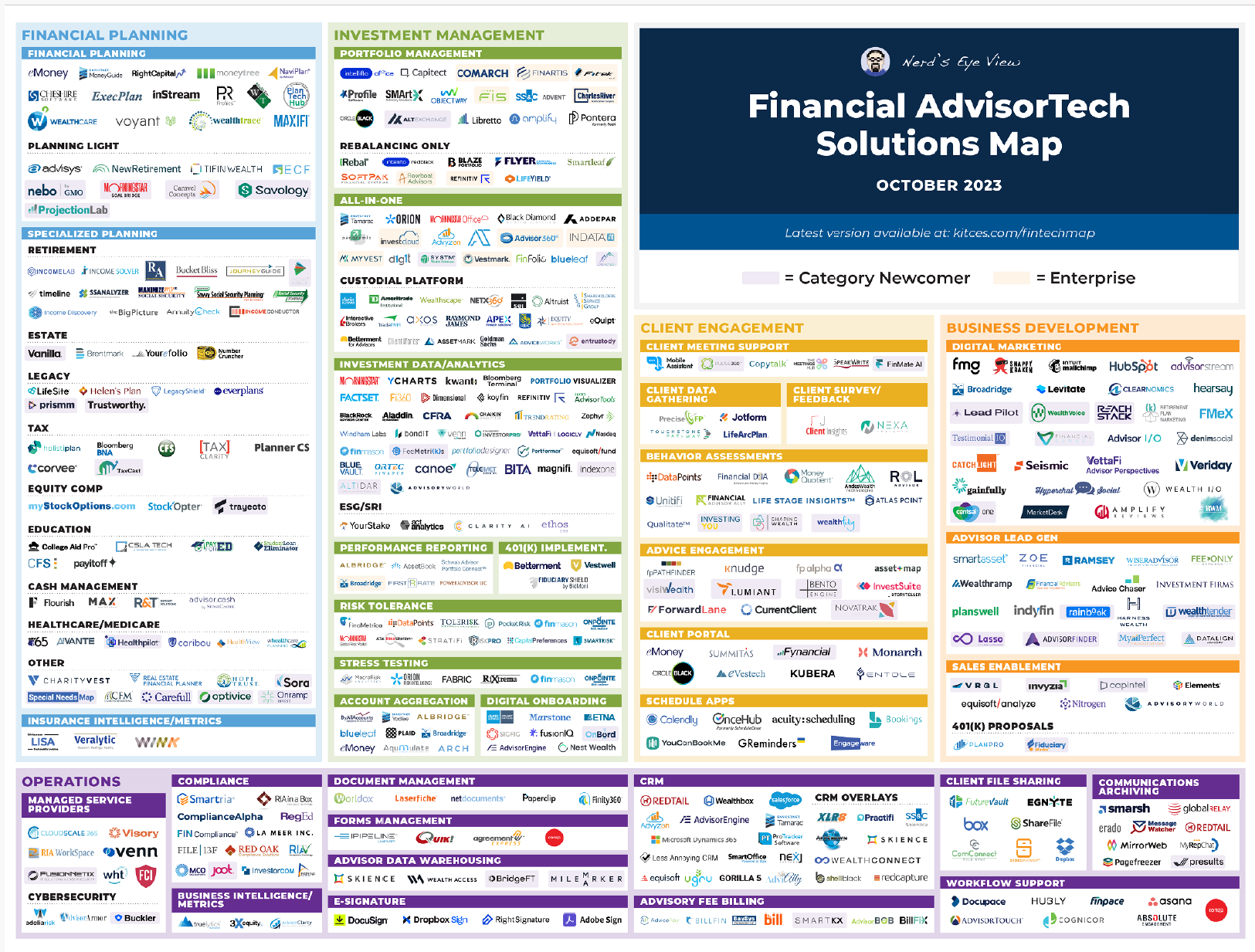

The alternative investment market has historically lacked the technical infrastructure seen by investors in traditional assets. However, within the last decade, an entire ecosystem has been constructed to streamline and ease administration processes – everything from digitized subscription agreements to asset reporting (both for RIAs and their clients). This ecosystem has proliferated, making alternative asset management a much more realistic feat for RIAs. See the illustration below, demonstrating the vast network of tools for financial advisors.

*Source: Kitces

At AET, we've contributed to this tech ecosystem by building RIA back office solutions to manage alternative assets within retirement accounts, integrating with leading TAMPs. Advisors can fund assets on our platform through retirement vehicles while streamlining asset and account data into their existing toolset.

Due Diligence & Deal Sourcing

Trying to find and vet deals can seem like an uphill battle. Where do you start? How do you maintain your fiduciary responsibilities?

Some platforms help registered advisors offer their clients access to alternative assets while maintaining those assets under management. Companies like CAIS act as marketplaces for private deals. CAIS serves both market sides – bridging the gaps between RIAs and asset managers. They also conduct their due diligence/partner with third parties to enforce the legitimacy of their associated offerings.

The platform is affiliated with CAIS Capital LLC, registered as a broker-dealer for private placements of securities and five other registrations related to insurance, annuities, mutual funds, and private fund conduits. The platform allows investment advisors to screen and offer clients opportunities to invest in private placements of equity-structured notes and to create custom funds. It also offers the ability of ease of investment execution with a fully digital process. This also creates the opportunity for advisors to offer investments screened to meet FINRA's reporting requirements, which should make it more efficient to get the alternatives approved if your broker-dealer has a process for reviewing such assets. Several companies are filling this gap, so be sure to research to find the right platform to meet your needs.

Closing

As more technology, marketplaces, and educational resources surface, the barrier to entry for alternative investments will continue to get lower. Clients will better understand alternatives at baseline, and RIAs will have more access to private deals and be able to make informed decisions for them.

- Woolley, Suzanne . 2022. “Will the 60/40 Portfolio Stage a Comeback in 2023?” Bloomberg.com, December 21, 2022.

- “CAIS | the State of Alternative Investments in Wealth Management.” 2022. Info.caisgroup.com. 2022.

- Horizon Investments. 2023. “Advisor Sentiment Survey Results.” Horizon Investments. October 3, 2023.

- Chladek, Natalie . 2021. “Understanding Time Horizons of Alternative Investments.” Harvard Business School. July 29, 2021.

Want to learn more about our custody solutions for RIAs?

Subscribe to the

AET Blog

Stay up-to-date with the latest articles, tips, and insights from the AET team